Making money in Real Estate

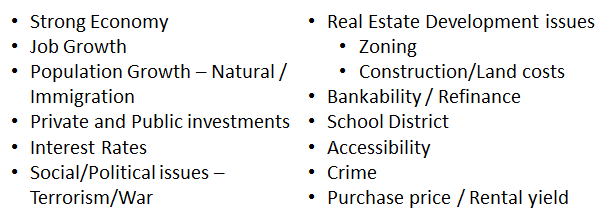

You must have heard that the 3 most important aspects of Real Estate investing are location, location & location. This makes sense as you can not move your land / house / building etc and therefore its location becomes vital. I therefore look at many factors before choosing a market. Some of these factors are listed below:

|

|

|

Once I choose the general market based on the above mentioned factors, I start purchasing real estate.

I make money in the following ways in Real Estate:

a. Sweat Equity - It is said that you make money at the time of purchase. By buying undervalued properties and then improving it by renovating it to high standards, I ensure that I have already made money the day I purchase the property.

See before and after pictures of one of my properties.

Before

I make money in the following ways in Real Estate:

a. Sweat Equity - It is said that you make money at the time of purchase. By buying undervalued properties and then improving it by renovating it to high standards, I ensure that I have already made money the day I purchase the property.

See before and after pictures of one of my properties.

Before

After

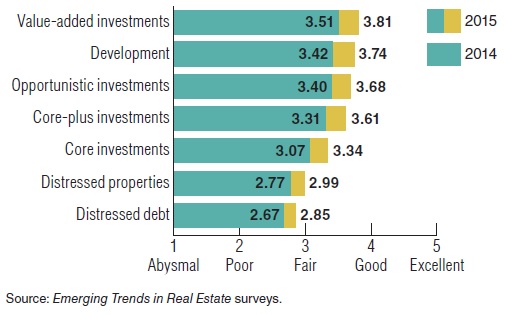

It is no surprise that in a survey of experts in the Real Estate industry conducted by PWC in 2015, Value-Added investments (like the ones explained above) provided the best returns as shown below:

|

|

|

b. Cashflow - Once renovated I rent the property on one year lease. I ensure I obtain at least 1% of the total acquisition cost in monthly rental income. With this I not only generate good cash flow, but the tenants also pay down my mortgage. The rents are increased moderately every year (in line with inflation).

c. Appreciation - I invest in markets which have a strong probability of appreciation in the coming years. With the 2008/09 real estate crash in the USA almost every state/city in the USA offered this opportunity. I targeted in markets that fell the most. Here is a price trend chart (source: www.Zillow.com) for city of Orlando, FL, where I have invested. As shown below, Orlando was hit hard in the real estate market crash. However, it is now on the upswing, which means strong appreciation for my properties.

Also watch a presentation below where I explain how perform my research before investing

|

|

|